Nov152022

Securities lawyer Chris Barsness talks about the recent collapse of FTX and its exchange and the chapter 11 bankruptcy filing by FTX Trading and issues around regulations. ...

Nov152022

Securities lawyer Chris Barsness talks about the recent collapse of FTX and its exchange and the chapter 11 bankruptcy filing by FTX Trading and issues around regulations. ...

Nov152022

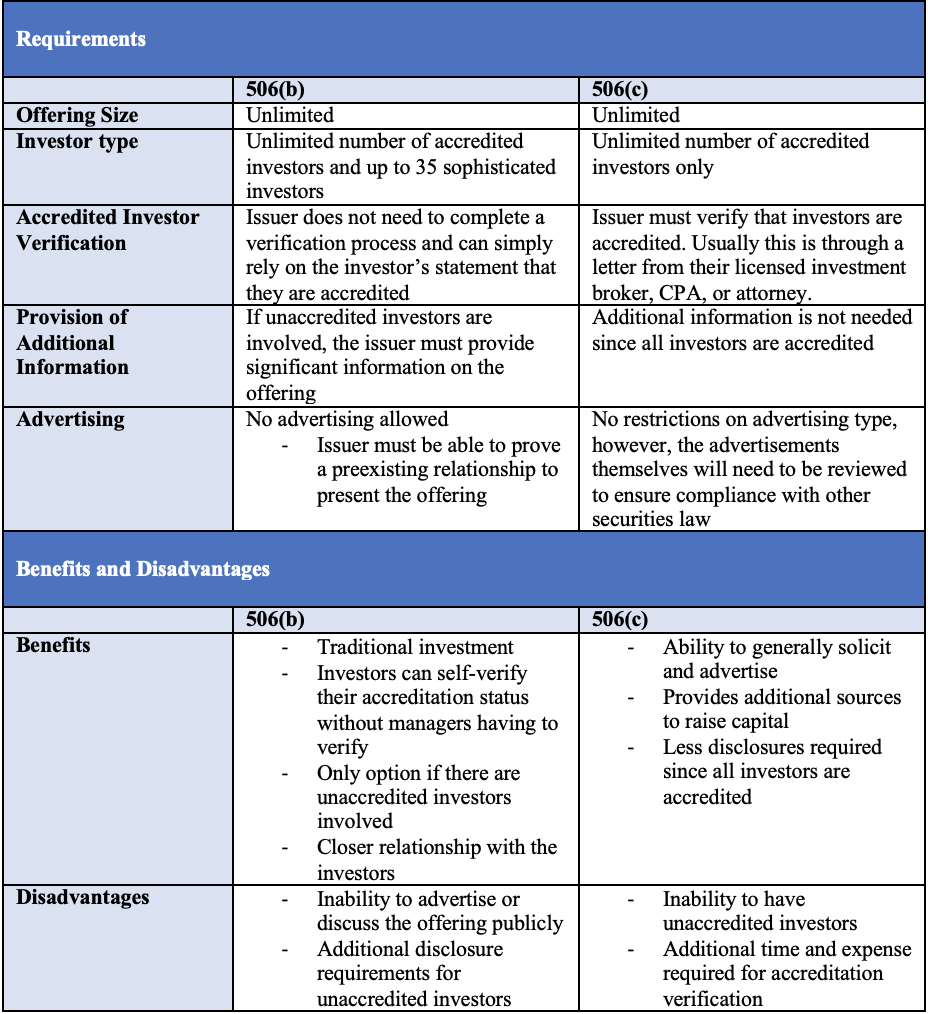

When raising capital in private offerings, issuers often rely on exemptions from registration under Regulation D of the Securities Act of 1993. Two of the most common exemptions are Rule 506(b) and Rule 506(c). While both exemptions allow private issuers to raise capital without registering with the SEC, each exemption has different requirements, limitations, benefits,...

Nov32022

[pdf-embedder url=”https://patel-law-group.local/wp-content/uploads/2022/11/Fund-versus-syndication.pdf” title=”Fund versus syndication”]...

Oct132022

On October 3, 2022, the Securities and Exchange Commission announced charges against Kim Kardashian for promoting a crypto asset security called EMAX, offered and sold by EthereumMax, on social media without disclosing the payment she received in exchange for the promotion. Kardashian agreed to settle the charges, paying $1.26 million in penalties, disgorgement, and interest,...

Aug252022

Many people start companies because they are passionate about their idea, product, or vision. Investors love to see that passion in a founder, but they are obviously wanting a return on their investment. This is where exit strategies come into play, sometimes referred to as a liquidity event. You could lump things like a dividend...

Aug102022

Common models used to value a company, how these apply to startups, stock valuation, stock option valuation, and comparisons with US GAAP accounting valuation. Common Company Valuation Methods Market Capitalization Most people are familiar with terms like “market cap” if they have any interest in publicly traded stocks. Market capitalization is a method that can...

Jul262022

So what exactly is a private placement memorandum (PPM) and why do I need one? What is a PPM? A private placement memorandum is an offering document, sometimes called a prospectus, offering circular, or PPM. The majority of early startups and emerging growth companies commonly raise money through what are known as private placements. It...

Jul252022

...